After a steep pullback that rattled currency markets earlier this week, the US dollar has staged a notable rebound against the Japanese yen, restoring some confidence among traders and investors. The USDJPY pair, which had been under pressure amid shifting expectations for US interest rates and renewed haven demand for the yen, is now clawing back lost ground as market participants reassess the macroeconomic outlook.This recovery comes at a pivotal moment for global foreign exchange markets, with central bank policy signals, economic data releases, and geopolitical tensions all converging to shape the next phase of volatility in one of the world’s most closely watched currency pairs.

USDJPY rebounds after sharp correction London trading desks reassess risk sentiment and safe haven flows

After yesterday’s abrupt slide shook out crowded long positions, the pair is climbing back as London desks recalibrate exposure and algorithmic models revert from “sell the rip” to range-rebuild strategies.Dealers report a sharp pick-up in interbank flows during the early European session, with real-money accounts trimming defensive yen holdings while macro hedge funds probe the upside amid a modest recovery in US yields. The move is underpinned by a tentative betterment in global equity sentiment, dampening demand for classic safe-haven plays, even as traders keep one eye on central bank rhetoric and another on the next US data print.

Market participants in the City are now dissecting the latest price action through a risk-management lens, with positioning, volatility and options skew all back under the microscope. Trading teams are focusing on:

- Reassessment of risk appetite across FX and rates books

- Options hedging to guard against renewed yen strength

- Cross-asset signals from equities, credit and Treasuries

- Event risk mapping around upcoming central bank meetings

| Factor | Current Bias | Desk Focus |

|---|---|---|

| US Yields | Mildly Higher | Support for USD |

| Risk Sentiment | Cautious Positive | Less Yen Demand |

| BoJ Policy Tone | Dovish-leaning | Cap on Yen Strength |

| Positioning | Lightened Longs | Room to Rebuild |

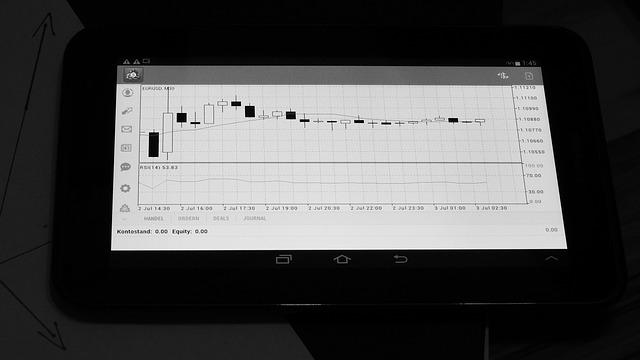

Technical levels in focus key resistance and support zones traders should watch in the days ahead

With the pair staging a rebound, traders are recalibrating around a cluster of well-defined inflection points that now frame the short-term battlefield between bulls and bears. On the upside,attention is gravitating toward psychological round numbers and prior swing highs,which together form a layered barrier to further gains. A sustained push through these bands would signal renewed buying conviction and open the door to a retest of this year’s peak. Until that happens, the risk of another pullback remains elevated, especially if intraday momentum turns lower around key pivot levels.

- First resistance zone: Former intraday high and nearby round figure

- Secondary resistance: Recent corrective top overlapping with 50% retracement

- Primary support: Last reaction low and short-term trendline confluence

- Deeper support: Area around the 100-day average and prior breakout region

| Zone | Type | Market Implication |

|---|---|---|

| Upper band | Resistance | Break above favors trend continuation |

| Mid-range | Pivot | Choppy trade; signals short-term bias shifts |

| Lower band | Support | Hold suggests dip-buying; break warns of deeper correction |

For short-term participants, these levels are shaping trade execution and risk management in the sessions ahead. Intraday desks are closely tracking how price behaves around the mid-range pivot, using it as a line in the sand to define whether the rebound still has traction or is losing steam. A pattern of higher lows above primary support would underpin the bullish narrative, while a daily close below the lower band could flip sentiment rapidly, forcing leveraged positions to unwind and shifting focus toward a more defensive stance.

Macro drivers behind the rebound how US yields Bank of Japan policy and data surprises shape the pair

At the heart of the latest bounce in the pair lies a renewed divergence in monetary policy expectations. As US Treasury yields tick higher on the back of resilient labor market prints and sticky core inflation, investors are re-pricing the path of Federal Reserve easing, pushing out the timing and depth of rate cuts. That contrasts sharply with the Bank of Japan, which remains wary of tightening too quickly after its cautious step away from negative rates. Markets continue to test the BoJ’s tolerance for yen weakness, with traders dissecting every hint from policymakers about potential currency intervention versus a preference for gradualism.

- Rising US yields revive the carry trade narrative.

- BoJ caution keeps Japanese rates anchored near zero.

- Intervention risk caps one-way speculative positioning.

- Data surprises on inflation and wages swing intraday sentiment.

| Driver | Market Impact |

|---|---|

| US yield spike | Supports dollar, lifts pair |

| Soft US data | Triggers profit-taking on longs |

| BoJ policy hints | Boosts volatility, tempers extremes |

| Japan inflation beat | Short-covering in yen |

Recent data surprises have added a tactical layer of noise to this broader strategic backdrop. Stronger-than-expected US numbers have repeatedly jolted the market out of a “Fed-is-done” narrative, while occasional upside shocks in Japanese wages and inflation have sparked short-lived rallies in the yen as traders flirt with the idea of a more assertive BoJ. For now, the balance of forces still favours dollar strength, but with positioning stretched and policymakers on both sides of the Pacific increasingly data-dependent, each new release on growth, prices and employment has the potential to redraw the near-term trading range.

Strategic takeaways for investors timing entries positioning around volatility and managing downside risk

As the pair claws back ground after its latest shakeout, opportunistic entries demand a blend of macro awareness and disciplined trade structuring rather than blind bottom‑fishing.Investors are increasingly using event-driven pullbacks around central bank announcements and data surprises to scale into positions, while keeping a close eye on yield spreads and risk sentiment indicators. In this environment, many portfolios are tilting toward staggered entry orders and partial profit-taking, aiming to capture intraday swings without overcommitting capital at a single price point.The focus is shifting from directional bravado to liquidity management, ensuring that position sizes remain small enough to survive abrupt reversals but large enough to benefit from the pair’s renewed momentum.

Downside protection is being treated less as an afterthought and more as a core pillar of strategy. More sophisticated investors are pairing spot positions with options overlays and tight contingency plans, favouring strategies that can withstand overnight gaps and policy surprises. Key themes include:

- Layered stop-losses beneath recent technical pivots to avoid forced exits on routine noise.

- Dynamic hedging via short-dated puts or cross‑currency exposure when volatility spikes.

- Position caps tied to portfolio value, limiting drawdowns from a single macro shock.

- Time-based exits if catalysts fail to materialise within a defined trading window.

| Market Phase | Entry Tactic | Risk Control |

|---|---|---|

| Post-correction rebound | Scale in on dips | Tight initial stops |

| Data-heavy week | Smaller probe positions | Options hedge |

| Policy uncertainty | Wait for breakout | Reduced leverage |

Key Takeaways

As the dust settles on the latest bout of volatility,the dollar-yen pair once again underlines its role as a barometer of global risk appetite and policy divergence. Whether this rebound marks the start of a sustained upswing or merely a pause in a deeper correction will hinge on the interplay between incoming data, central bank signalling and broader market sentiment in the weeks ahead. For now, traders and corporates alike will be watching USD/JPY levels closely, knowing that each move carries implications well beyond the foreign exchange screens.